Heterodox Risk Ideas

Part 6 of the the investment sequence"Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally."

The Heterodox Positions

Before getting into, the heterodox, let's briefly touch on the orthodox Risk premium. In Wikipedia. In addition to volatility risk and liquidity risk, there exist a variety of other risks worth acknowledging. These risks include catastrophic risks such as "crashes" that occur outside a standard log-normal return distribution, risks that are hard or impossible to model Knightian uncertainty (e.g. the risk your asset will be outlawed or your investing institution will disappear), and risk to your reputation.

In order to get investors to buy them, assets with these risks need to offer extra expected returns - these extra returns are called the risk premium. The orthodox view is that that riskier assets offer higher expected returns - in other words the orthodox view is that the risk premium is positive.

A collection of heterodox views maintain that, in many contexts, the risk premium is actually zero or, possibly, even negative.

One heterodox position is that professional investors who manage other people's money are rewarded for succeeding but not punished for failing so long as the failure was "conventional". For this reason, professional investors actually prefer risky assets Hanson.

A second heterodox position is that people don't just care about their absolute wealth - they also care about their relative wealth. Some simple extensions of standard models where agents maximize relative wealth results in the predicted risk premium being zero or even negative (pg 96 of Falkenstein).

What about empirical research? I haven't fully examined the orthodox side yet (TODO), but the heterodox side does have some decent empirical support (pg 62 and 98 - 134 of Falkenstein). Probably the most controversial Falkenstein makes is that the equity risk premium is actually 0, rather than significantly positive (the orthodox position Equity premium puzzle). Allow me to provide my interpretation of this last argument.

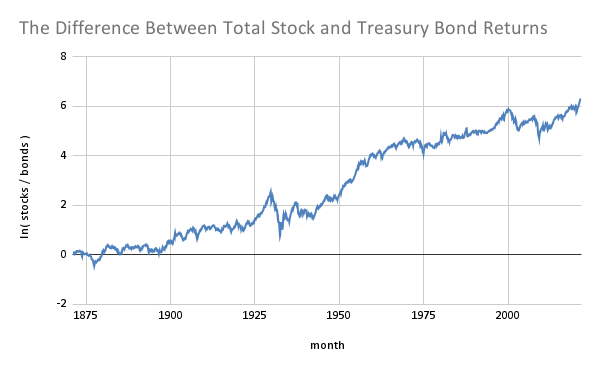

Stocks have outperformed bonds in the US for over a century:

Since 1871, this excess has averaged 4.1pp per year (3.2pp since 1970). Naively this observation supports the orthodox idea that equity earns greater returns as a consequence of its risk. However, note the following:

- The US stock market has generally outperformed foreign stocks. Since 1970 the difference has averaged 3.7pp. So, by this issue alone, it's reasonable to infer that this observed equity premium could more accurately be described as "US stocks consistently outperform bonds while foreign stocks consistently match them."

- The interest on US bonds has generally been significantly lower than other government bonds, presumably due in part to the dollar's status as the world reserve currency.

todo Mehra "around 3–3.5% on a geometric mean basis" for global equity markets during 1900–2005 (2006)

From this it seems likely that the US historical performance is anomalous and that, in general, the equity premium is quite small and possibly zero.

Falkenstein also discusses an observation I stumbled upon by accident years ago: returns are not historically predicted by stock volatility, beta, or epsilon. Note the huge contradiction here: the CAPM model predicts beta is the sole predictor of returns.

Falkenstein discusses some other pieces of evidence, but I think those two are the most compelling points, because they represent refutations of the most well-known predictions of the orthodox models.

Reconciling The Two

As with many disagreements, there are some word games at play here that deserve special attention.

First, the heterodox position about other types of risk not being appreciated by orthodox models is a well deserved criticism of such models, but I suspect pretty much every orthodox financial economist would agree. So, this is more a disagreement in emphasis than actual facts.The second word game at play is what counts as "returns". The two common definitions are arithmetic and geometric returns.

People who claim arithmetic return are the true "risk neutral" measure point out that it is the true definition of "risk neutral", because when examining a return, utility is literally equal to wealth.

Proponents of geometric returns point out that, in the long run, investors with the highest geometric returns end up with the most wealth. Heck, they say, this is literally equivalent to the Kelly criterion - the so-called "scientific gambling method" Kelly criterion.

Both these claims are true, reconcilable with some basic algebra, and the disagreement is purely definitional: what does "risk neutral" mean precisely?

In my opinion, the "heterodox" position is largely correct: when considering logarithmic returns, the bulk of the evidence suggests that investors are attempting to maximizing log-wealth. Indeed, a friend who works at a hedge fund has explicitly told me they use the Kelly criterion when making decisions, which is literally equivalent to maximizing geometric returns.

The evidence between asset classes is more mixed. While I buy that US stock returns are significantly afflicted by survivorship bias,